Check you can get insurance before you purchase a property

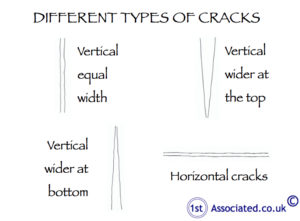

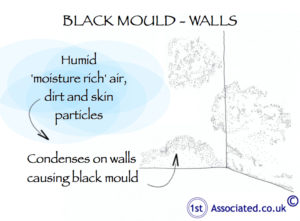

We are knowledgeable and experienced Building Surveyors who have also dealt with all sorts of insurance claims over the years and are happy to provide independent advice on how a property problem should be resolved. We have dealt with everything over the years from subsidence to heave and structural movement causing cracking and other such damage to the building and have also dealt with dampness in the form of rising damp (if it really exists) and lateral or penetrating damp and condensation (the most common type of dampness and often wrongly diagnosed) together with bad workmanship issues from over charging for building work to general poor management of a building project.

We are knowledgeable and experienced Building Surveyors who have also dealt with all sorts of insurance claims over the years and are happy to provide independent advice on how a property problem should be resolved. We have dealt with everything over the years from subsidence to heave and structural movement causing cracking and other such damage to the building and have also dealt with dampness in the form of rising damp (if it really exists) and lateral or penetrating damp and condensation (the most common type of dampness and often wrongly diagnosed) together with bad workmanship issues from over charging for building work to general poor management of a building project.

We believe we have just about carried out reports giving advice on every type of property issue over the years. We do of course realise that every property problem is unique and we carry out tailor made surveys to identify any property issues. Please do have a friendly chat with us on free phone 0800 298 5424.

We believe we have just about carried out reports giving advice on every type of property issue over the years. We do of course realise that every property problem is unique and we carry out tailor made surveys to identify any property issues. Please do have a friendly chat with us on free phone 0800 298 5424.

Free phone 0800 298 5424

Why it is important for you to have an independent building survey? Without one you could have considerable costs.

We would recommend as we are independent building Surveyors and this is an advert that you have your own independent building survey carried out where a property has had an insurance related problem. Remember caveat emptor means buyer beware and is why you need to have the advice of an independent building Surveyor working for you to find out if there are any problems within the property and you will be able to meet them at the property to talk about any issues and concerns you have. Remember also that the estate agent will certainly will not advise you of any problems as they are trying to sell the house.

Bear in mind the independent building Surveyor that you employ will be the only person working for you with your interests at heart.

Mad as it may seem you may not be able to get insurance on a house that is already insured

We have over the past decade or so come across more and more cases where insurance companies are simply no longer willing to insure houses in an area. When you are buying your new house and home make sure that the property is insurable or if the property does have a large insurance premium factor this cost into the amount you are prepared to pay for your new house and home.

Reasons why an insurance company will not insure a house

Whilst we have no factual evidence for what we are about to say other than we have observed as building Surveyors carrying out structural surveys on houses it would seem that areas by postcode are being designated as problem areas. An area we know very well that once upon a time was designated as an area that could possibly flood would of course affect houses at the bottom of the hill near the river the insurance companies have now extended postcode-wise to include properties at the top of the hill. The top of the hill is a very improbable flood area and as far as we are aware in living memory has never flooded and indeed would mean hundreds of houses literally would have water over the top of their roofs and chimneys to flood the houses at the top of the hill!

Whilst we have no factual evidence for what we are about to say other than we have observed as building Surveyors carrying out structural surveys on houses it would seem that areas by postcode are being designated as problem areas. An area we know very well that once upon a time was designated as an area that could possibly flood would of course affect houses at the bottom of the hill near the river the insurance companies have now extended postcode-wise to include properties at the top of the hill. The top of the hill is a very improbable flood area and as far as we are aware in living memory has never flooded and indeed would mean hundreds of houses literally would have water over the top of their roofs and chimneys to flood the houses at the top of the hill!

We can understand an area that has constantly flooded being difficult to insure or very expensive to insure but the use of postcode data seems to have gone mad in this particular instance. We are also aware of other areas where due to subsidence problems from clay etc most of the major insurance companies will no longer insure properties.

When buying a new house we recommend, wherever possible, to stay with the existing insurance company

We have for many years particularly where there are potential problems advised our clients to keep with the existing insurance company. This recommendation is so that there can be no passing of blame between insurance companies.

Insurance problem means the insurance company no longer wants to insure the property

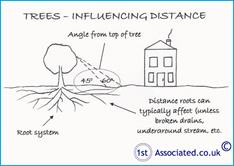

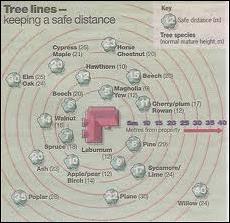

An interesting new twist to the insurance problem is where there has been an issue with the property such as a tree that was deemed to be growing too close to the property that the insurance company has via their loss adjusters (that they employ to work for them) have decided to cut the tree down and then decided that the next year not to insure the property and not to insure our client the prospective purchaser at any cost.

An interesting new twist to the insurance problem is where there has been an issue with the property such as a tree that was deemed to be growing too close to the property that the insurance company has via their loss adjusters (that they employ to work for them) have decided to cut the tree down and then decided that the next year not to insure the property and not to insure our client the prospective purchaser at any cost.

|

|

|

Trees cut down |

Nearby tree |

Influencing Distance Defined

This is the distance in which a tree may be able to cause damage to the subject property.

We would comment that in our experience as independent Surveyors that with trees it is often best not to cut them down but to maintain the trees regularly. However, unfortunately insurance companies are looking for a one off solution rather than this maintenance type solution.

When a tree was cut down in its entirety the result unfortunately can be that as the tree is located close to properties that have got used to the tree taking water away over the years and then when cut down heave can result. This we suspect is why insurance companies will no longer insure some properties.

Heave Defined:

Heave is an upward movement caused by activity in the ground.

Check a property is insurable before you commit to purchase the property

It is a very easy task to carry out to check to see if the current insurance company will insure the property that you are looking to buy. We have come across several people that have not checked if they can get insurance cover or checked at the very last minute.

It is a very easy task to carry out to check to see if the current insurance company will insure the property that you are looking to buy. We have come across several people that have not checked if they can get insurance cover or checked at the very last minute.

We have been asked for rules of thumbs as to when an insurance company will not insure a property and unfortunately we have not been able to offer such advice as it does seem to vary from insurance company to insurance company.

Does a Certificate of Structural Adequacy mean the house has no problems?

In our experience it certainly does not mean that a Certificate of Structural Adequacy means the house has no problems but means that the existing owner who has had insurance work carried out.

Please see our article on this:

Certificate of Structural Adequacy

In the middle of an insurance claim

If you have read this article as you are in the middle of an insurance claim we do deal with insurance company problems and provide independent expert opinions on insurance claims. Contact us on free phone 0800 298 5424 as we may have given advice on a similar insurance claim to yours.

We have written surveying and Specific Defect articles that may help you:

Specific Defect Reports

Cracks in my wall

Structural reports

How, in our experience, insurance companies deal with cracks in properties

What do the circles and ovals mean in our Specific Defect Reports?

In our Specific Defect Reports the circles and ovals are a system that we used to highlight property problem areas so that you are not left wondering what the property problem is. In addition to this if the Specific Defect Report photographs do not we believe explain the property problem enough together with our description we also add in one of our own survey sketches.

Commercial break for our surveys

Compare our website and compare our quality surveys

Have a look around our website to check out the quality of our website and our Specific Defect Reports. We pride ourselves on our professional standard and easy to read reports which we have been carrying out for many years on every age, type and style of property across the UK.

Phone us on free phone 0800 298 5424 and we will be happy to send you an example of a Specific Defect Report most likely typical to the property or property problem you are looking at. We literally have hundreds of downloadable Structural Surveys and Specific Defect Reports on our website so have a look around our website; if you cannot find what you are looking for do give us a call and we will find them for you.

We can send you examples of Specific Defect Reports so you can see what you will be getting

Please contact our office; we may be able to give you examples of Specific Defect Reports that we have dealt with similar to yours and help you understand how to deal with your particular issue.

Surveying articles

We hope you found the article of use and if you have any experiences that you feel should be added to this article that would benefit others, or you feel that some of the information that we have put is wrong then please do not hesitate to contact us (we are only human).

The content of the website is for general information only and is not intended to be relied upon for specific or general decisions. Appropriate independent professional advice should be paid for before making such a decision.

All rights are reserved the contents of the website are not to be reproduced or transmitted in any form in whole or part without the express written permission of www.1stAssociated.co.uk