Taking the insurance company to court

was the only option

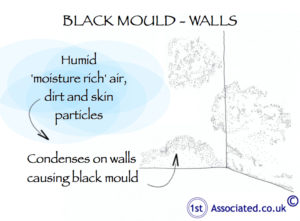

We are experienced Building Surveyors who have also dealt with all sorts of insurance claims over the years and are happy to provide independent advice on how a property problem should be resolved. We have dealt with everything over the years from subsidence to heave and structural movement causing cracking and other such damage to the building and have also dealt with dampness in the form of rising damp (if it really exists) and lateral or penetrating damp and condensation (the most common type of dampness and often wrongly diagnosed) together with bad workmanship issues from over charging for building work to general poor management of a building project.

We believe we have just about carried out reports giving advice on every type of property problem over the years. We do of course realise that every property problem is unique and we carry out tailor made surveys to identify any property issues. Please do have a friendly chat with us on free phone 0800 298 5424.

Free phone 0800 298 5424

No one knows the quality of their insurance until they make an insurance claim

We heard the most amazing story on the radio about a fake insurance company that took an incredible amount in insurance fees for insuring properties etc... but they were not an insurance company at all.

We heard the most amazing story on the radio about a fake insurance company that took an incredible amount in insurance fees for insuring properties etc... but they were not an insurance company at all.

The fake insurance company was found out only after it had been operating for sometime (we assume no one made an insurance claim) and from what we could understand from the news programme that the fake insurance company con was so good that the fraudsters actually set up another fake insurance company!

We heard this story as we were travelling to carry out a structural survey on the radio and have not carried out any further investigation but it did seem an amazing story.

Insurance companies rely on trust and reputation very few of us will read the details of the policy

Whilst the radio programme gave many various interesting facts etc a few things stuck in our mind one was that the fake insurance company issued real looking insurance documentation so everyone thought that they were insured taking many, many thousands of pounds over many months before they were found out.

Whilst the radio programme gave many various interesting facts etc a few things stuck in our mind one was that the fake insurance company issued real looking insurance documentation so everyone thought that they were insured taking many, many thousands of pounds over many months before they were found out.

We all have to trust an insurance company will do what they say they are going to do it is only when you use an insurance company that you truly find out how good or bad the insurance company is.

With an insurance company you do not know the service you are getting until you have an insurance claim

The point that interested us about the above was that to have an insurance company all you have to do is issue an insurance document for people to believe that everything is in order. You have no way of testing the service before you have an insurance claim! Unlike the structural survey that we were driving to that day where our clients typically meet us at the property and receive their structural survey typically within approximately three days. Whereas with insurance companies and fake insurance companies you simply telephone to purchase the intangible service which ninety nine times out of a hundred you do not actually use you just get the paperwork forwarded to you.

The quality of the insurance company is only known when an insurance claim is made

It is only when you make an insurance claim that you start to understand how your insurance works and how good your insurance cover is as well as possibly finding out how good your insurance company is at avoiding paying your claim.

We help people with insurance claims

Most people tend not to make insurance claims but when they do make a claim it is a relatively new procedure for them whereas insurance companies are dealing with insurance claims everyday. We believe that the vast majority of people are being treated fairly by their insurance companies or there really would be uproar however there are of course cases where things go wrong which is where we can help.

Most people tend not to make insurance claims but when they do make a claim it is a relatively new procedure for them whereas insurance companies are dealing with insurance claims everyday. We believe that the vast majority of people are being treated fairly by their insurance companies or there really would be uproar however there are of course cases where things go wrong which is where we can help.

Insurance company loss adjusters and loss assessors also known as adjustors and assessors

Often with a property problem the insurance company will appoint a loss adjuster who is an expert in insurance claims often with property knowledge and experience to deal with the claim for the insurer. It is very important to remember that the insurance adjuster is dealing with the claim for the insurer and are not independent and therefore we would say are always working in the best interests of the insurers. As such the insurance adjusters get to know their insurance policies inside out.

We give independent expert advice

We are independent Surveyors and as such we give independent advice and give best advice on what is best in the long term. From what we have seen sometimes insurance loss adjusters are trying to resolve the problem quickly and as such carry out work that has a short term rather than long term solution and is simply quick and convenient. Sometimes the loss adjuster knows the insurance policy so well that they try to slip matters through a loop hole.

Let us give you some examples of insurance issues we have dealt with:-

The quick insurance solution

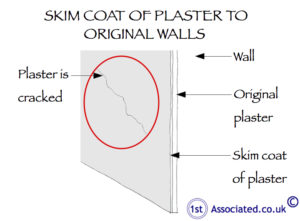

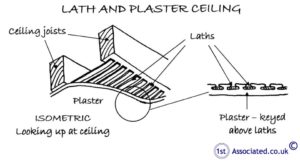

When dealing with an older property it has older methods of construction. The older property was flooded causing damage throughout and was severe involving all the plaster on the walls having to be removed. As the property was an older style the plaster was lath and plaster however the insurance company builders replaced the plaster with a modern gypsum plaster which was totally inappropriate for the age of property.

The technical reason for this in a nutshell is that the old lime plasters breathed whereas the modern plaster does not breathe to the same extent. The result of the plasterwork being carried out in modern gypsum plaster is that the property now has dampness.

We believe that the correct course of action is to remove all the new gypsum plaster and completely re-plaster in a lime plaster. The insurance company are resisting carrying out this action advising that they have carried out similar work in most cases with no issues which may or may not be correct; we simply do not have statistics and information but we can see and everyone can see from the tests that we have carried out from thermal imaging to damp resistance testing that the property is damp.

An example of knowing the insurance policy small print very well and not helping out at all

We have also dealt with a fire incident where, we believe, the insurance policy details in the small print had been used to limit the insurance claim. The property was rented out and when the fire occurred the landlord re-housed the tenants. Unfortunately for the landlord under the insurance policy small print it advised that if there was a fire in the property the tenancy agreement would be void and there was no right or responsibility to have to re-house the tenants. The result of this scenario has been that the landlord has a large bill renting out another property for the tenants to live in whilst the fire damaged property was refurbished.

We have written surveying and Specific Defect articles that may help you:

Specific Defect Reports

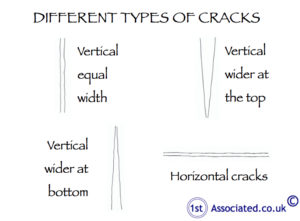

Cracks in my wall

Structural Report

How, in our experience, insurance companies deal with cracks in properties

Check you can get insurance before you purchase a property

Insurance claim

Over the years, we would say that, insurance claims and disagreements full into several categories:-

1. Misunderstanding

Misunderstanding what the client was expecting the insurance to cover and what the insurance covered.

2. Difference of opinion

Fairly commonly there is a difference of opinion as to what the insurance covered and where the insurance cover should start and stop. However, the other area is where the technical solution proposed by the insurance company is best for the insurance company rather than being best for the client.

Structural problem and insurance claim

An insurance claim we have dealt with involved structural problems in a house where the insurance company believed that the problems were acceptable. When monitored for a period the movement was shown to be progressive.

Trees and insurance claim

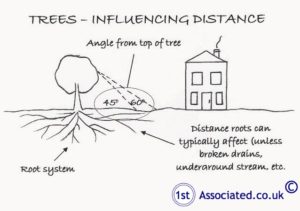

Another structural claim we dealt with is where the trees were deemed to be too close to the house so the trees were removed completely.

We believe that the trees should have been cut back and regularly maintained. The removal of the trees unfortunately then caused further structural damage.

Wrong technical solution

As already mentioned sometimes a technical solution that the insurance company loss adjusters come up with is what is best for the insurance company as opposed to what is best for the property.

We can give you numerous examples of this with one of the best examples where a Glass Reinforced Plastic (GRP) roof damaged by sunlight and then leaked, Glass Reinforced Plastic (GRP) roofs that have buckled (not to say that all non traditional building techniques do not work) and a Green roof (which is a grass roof) which was being blamed for leaking but we discovered the property problem was condensation within the property.

|

|

|

|

Mono-ply roof |

Rucking to mono-ply roof |

Green, living roof |

We have equally been involved with very traditional building techniques such as slate and traditional clay tile roofs that due to the builder having a lack of experience had not carried out the roofing work correctly which lead to leaks.

|

|

|

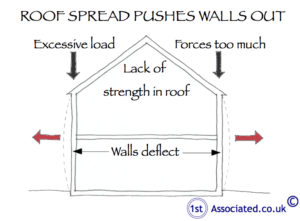

Replacing a slate or tile roof with heavier concrete tiles without adding support to roof can result in roof spread and failure of common rafters |

Dampness getting into the roof |

In these situations we can offer the correct solution detailing the issue via either one of our surveying sketches as we do come across the same problems time and time again or we have the facility to make tailor made solutions.

What do the circles and ovals mean in our Specific Defect Reports?

In our Specific Defect Reports the circles and ovals are a system that we use to highlight property problem areas so that you are not left wondering what the property problem is.

In addition to this if the Specific Defect Reports photographs do not we believe explain the property problem enough together with our description we also add in one of our own survey sketches.

Commercial break for our surveys

Compare our website and compare our quality surveys

Have a look around our website to check out the quality of our website and our Specific Defect Reports. We pride ourselves on our professional standard and easy to read reports which we have been carrying out for many years on every age, type and style of property across the UK.

Phone us on free phone 0800 298 5424 and we will be happy to send you an example of a Specific Defect Report most likely typical to the property or property problem you are looking at. We literally have hundreds of downloadable Structural Surveys and Specific Defect Reports on our website so have a look around our website; if you cannot find what you are looking for do give us a call and we will find them for you.

We can send you examples of Specific Defect Reports so you can see what you will be getting

Please contact our office; we may be able to give you examples of Specific Defect Reports that we have dealt with similar to yours and help you understand how to deal with your particular issue.

Surveying articles

We hope you found the article of use and if you have any experiences that you feel should be added to this article that would benefit others, or you feel that some of the information that we have put is wrong then please do not hesitate to contact us (we are only human).

The content of the website is for general information only and is not intended to be relied upon for specific or general decisions. Appropriate independent professional advice should be paid for before making such a decision.

All rights are reserved the contents of the website are not to be reproduced or transmitted in any form in whole or part without the express written permission of www.1stAssociated.co.uk