How easy is it to get a mortgage on a BISF house, also known as British Iron and Steel Federation house?

We specialise in surveys on BISF British Iron and Steel Federation houses and have been working with these properties for many years. We offer a reasoned view, based upon our knowledge and experience. We don't make a mountain out of a molehill. Equally, if we think the house has problems we say so in a clear, jargon-free manner. We also use sketches, photographs and digital images to clarify what we are saying within our detailed reports. We even give you prices on work required.

Lived in the property for 25 years and cannot get a mortgage, what an earth is that all about?!

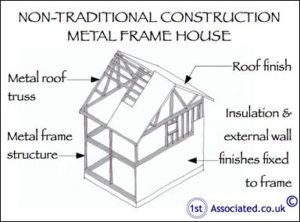

Our client contacted us as she and her husband had been offered the Right to Buy the semi-detached Council house they had lived in for 25 years and wanted us to carry out a full residential building survey. The 65 year old house was a non-traditional metal framed construction known as a British Iron and Steel Federation BISF house and was built just after the War years when there was a great need for housing.

A BISF house looks like a normal house, rendered on the outside, it has a shallow pitched roof, looks like a tile but when you look closely it isn’t in fact a tile its metal as you would expect with something made by the British Iron and Steel Federation. Possibly asbestos if it is in its original format.

The couple had decided to apply for a mortgage through the Halifax as their neighbours had recently been through the same process with the Halifax, which had all run smoothly.

The lender had already carried out our client’s valuation and they were looking forward to very soon owning their own home. Little did we all know the problems that would arise!

Our Independent Surveyor to the rescue

Our Independent Building Surveyor carried out a full visual residential building survey on the house where it was found none of the areas inspected could be termed as structurally affecting the property. Within the roof structure we even found the level of rust to be slightly below average, not bad or excessive although we did make our client fully aware they were buying a non-traditional house and the problems that can be inherent with them when or if they were to ever to want to sell the property.

The clients seemed happy with the findings and felt they were a step closer to becoming house owners.

We have provided structural surveys, property reports and tailor made reports over the years to help our clients gain the information required to support their mortgage application. Free phone 0800 298 5424 today if you would like us to help you.

Do banks and building societies really know what they are doing?

Then the problems started!

The Halifax Building Society thought there was a problem with the property as it was a non-traditional build even though they had given mortgages for other properties nearby and indeed the property next door we were told (we haven’t carried out any legal checks on this we have just taken the word of the neighbours that we spoke to). The problem was the Halifax didn’t have a policy in place to resolve it!

Our clients were advised by the valuer, working on behalf of the Halifax, that the Halifax had asked for the house to be opened up. We asked:-

- Exactly how many openings were required?

- The location of the openings?

- What size openings were required?

Our clients were then told by the valuer the holes should be cut into the internal walls, close to the base of the vertical structural columns, to check for corrosion at the joint between the columns and floor slab. They also suggested investigation at first floor level to check column conditions at the point where when the house was built; originally there was a lipped joint between the render and steel cladding, which was a point of weakness.

This we believed did not answer our original questions so we contacted the valuer who told us he was only following guidance notes from the Halifax in requesting the house to be opened up and could not be any more specific. He advised we call his Head Office and ask them about another non-traditional property he had requested to be opened up and find out exactly where this was opened, how many openings and the size of the openings from the Surveyor that carried this out.

We then contacted his Head Office to be told they had not yet received the report back so had no idea!

Don't Delay Call our Friendly Non Traditional House Experts today 0800 298 5424

Feeling frustrated?

1stAssociated Surveyors never give up!

Feeling like we were getting nowhere and feeling for the poor client who was getting very frustrated, we then made contact with a Technical Support Manager at the Halifax Surveyors (who used to be called Colleys) who advised through the Mortgage Advisor that the Structural Engineer or Chartered Building Surveyor needed to confirm that he is happy with the steel frame of the property and that the corrosion, if any will not affect the future stability of the property going forward. He advised he does not require a specific number of holes or a specific size - just that he needs confirmation of the stability of the steel frame.

Non-traditional properties

Again, this was not the answer we required so we emailed the Tech Support Manager at Halifax Surveyors advising that we had already carried out a structural survey on this property and given our comments based upon what we could see of the roof structure and a visual inspection of the whole property, which is what we always do. We said we have never before been asked to open up a property without any guidance or any specific reason to open it up other than that this is a BISF house of non-traditional construction. We advised no one is able to guarantee the future stability of a non-traditional property, we simply don’t have the history of them.

We gave them our proposal of how many areas we intended to open up using the Building Research Establishment BRE as guidance and asked them for their comments. We advised even with these areas opened up we would only be able to specifically comment on these areas and give an indication of any potential problems and advised them it is only with the opening up of the whole structure, which we are not aware has ever taken place for a mortgage that we would be able to give assurance on the future stability of the property.

We wanted to understand specifically what concerns they had with this property over and above the other BISF houses as we could not see anything specific.

The normal process is to have guidance from the condition of the roof and we have never had our reports questioned previously. We have only opened up the structure of a property in the past:-

- Where major works have been carried out or

- Proposed to the property or

- There has been a specific element identified by the mortgage valuer as a defect in the property

We can then focus our investigations in this specific area.

At this stage the client was feeling no matter what they did it would not be good enough to pass the mortgage requirements and considered pulling out altogether.

For Help with Non Traditional houses Free Phone 0800 298 5424

Another visit from a valuer!!

The client then had a call advising another valuer would be visiting the property. After this visit we were advised by Halifax Surveyors that the lenders and Panel Surveyors are working together to resolve the issues with the lending on this property and they doubted we would have to go out to open up the property.

And as time ticks on we are still waiting!

A few days later we spoke again to our client who advised she had been left a voice message by the mortgage advisor advising the Panel Surveyors have passed it but to date the client is still awaiting for written confirmation of this! We think that any day now the property mortgage will get passed and they will be homeowners.